In 2025, Italy offers tax incentives for those who install energy-efficient air conditioners and heat pumps. This program is only valid in Italy and allows homeowners, tenants, and businesses to save up to 65% of costs through tax deductions or direct contributions. If you live in Italy, own property there, or are planning to invest in Italian real estate, this scheme may be relevant for you.

A concrete opportunity in Italy to improve comfort and efficiency

The Italy 2025 Air Conditioner and Heat Pump Bonus is a tax incentive designed to support those who choose efficient and sustainable systems. Whether for summer cooling, winter heating, or domestic hot water production, the benefits offer savings of up to 65% of the cost, even without building renovations. Both air conditioners and heat pumps can fall under different types of bonuses, with specific rules, differentiated rates, and well-defined technical requirements.

Which bonuses are available in 2025

In 2025, the main incentives available in Italy for the purchase and installation of air conditioners and heat pumps are:

|

Renovation Bonus

|

|

Ecobonus

|

|

Conto Termico 3.0 (managed by GSE)

|

Sources:

Viessmann – Guida detrazione fiscale, Bosch – Incentivi pompe di calore 2025, TG24 Sky – Bonus condizionatori 2025

Who can benefit?

The bonus is accessible to a wide range of beneficiaries, even non-owners:

- Owners or bare owners (nuda proprietà);

- Usufruct holders or borrowers under a free loan (comodato);

- Tenants and renters;

- Co-resident family members;

- VAT-registered professionals, cooperatives, and condominiums.

Important note: the person claiming the deduction must pay the expense and be listed on both the invoices and the bank transfer.

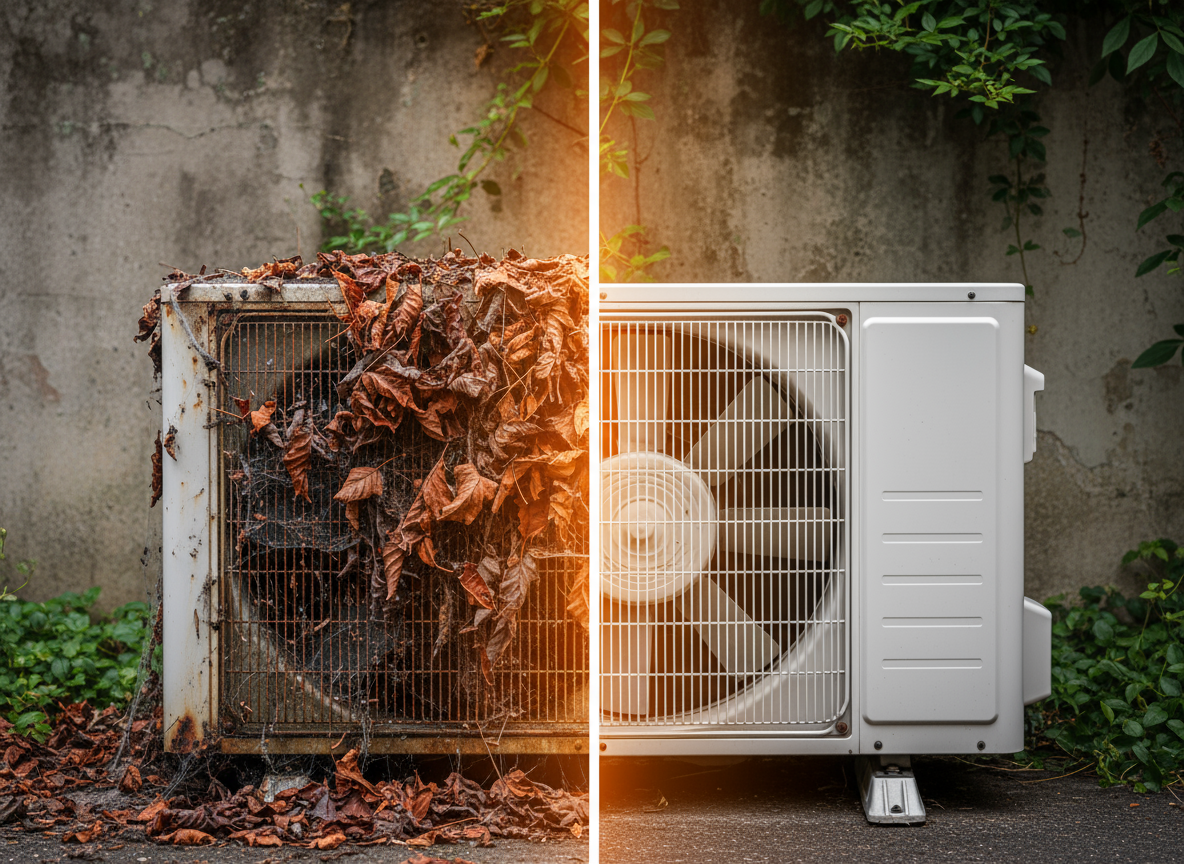

Which systems are eligible?

For air conditioners:

- Cooling-only systems;

- Inverter models (cooling and heating);

- Centralized or split systems;

- Must be energy class A or higher.

For heat pumps:

- Air-to-air, air-to-water, or geothermal heat pumps;

- Hybrid systems integrated with boilers;

- Heat pump water heaters for domestic hot water;

- Must be technologically efficient and certified.

Note: all systems must contribute to improving the building’s energy efficiency.

How to obtain the 2025 Bonus: documents, timelines, and procedures

To correctly access Italy’s 2025 Air Conditioner and Heat Pump Bonus, you must follow a series of technical and fiscal rules. Below is an operational checklist to avoid common mistakes and set up your application correctly.

1. Payment via “bonifico parlante”

Payment must be made with a “bonifico parlante”, a specific Italian bank transfer for tax incentives, available at most banks. It must include:

- the payment description with the legal reference (e.g., “Intervento agevolato ai sensi dell’art. 16-bis del DPR 917/1986”);

- the tax code of the deduction beneficiary;

- the tax code or VAT number of the company carrying out the work.

For Conto Termico 3.0, a standard bank transfer is sufficient, provided it is traceable and accompanied by the correct technical and fiscal documentation.

2. Correct invoice heading

The right to the deduction applies exclusively to the person who pays and is listed on both the bank transfer and the invoice. Invoices must therefore be made out to the same person who makes the payment and intends to claim the deduction in their tax return.

For condominium works, the individual unit owner must keep documentation relating to their share of the expense.

3. ENEA communication (Ecobonus)

If applying for the Ecobonus, you must submit the communication to ENEA within 90 days of completion of the works via the official portal: bonusfiscali.enea.it

Submitting the data certifies the energy efficiency improvement and is essential for the validity of the deduction.

4. Timelines and use

IRPEF deductions (Renovation Bonus and Ecobonus) are recovered in 10 equal annual installments in the tax return.

Conto Termico 3.0 is a direct incentive: the reimbursement is credited to the beneficiary’s bank account, even in a single payment, generally within 60 days for amounts under €15,000.

For more information, visit the GSE portal: www.gse.it

5. Cumulability of bonuses

You cannot combine multiple incentives for the same intervention. You must choose either an IRPEF deduction (Renovation Bonus or Ecobonus) or the Conto Termico.

However, it is allowed to combine different incentives for different interventions within the same property (e.g., Ecobonus for the heat pump and Renovation Bonus for window replacement).

Further clarifications on cumulability are available on the Italian Revenue Agency website.

6. Documentation to keep

In the event of checks by the Revenue Agency, you must be able to provide:

- copies of invoices and bank transfers;

- technical documentation of the installed system;

- product sheets and manufacturer certifications;

- updated system booklet;

- receipt of the ENEA communication (for Ecobonus);

- any declarations or certifications from the installer.

All these documents must be kept for at least 10 years, i.e., for the entire duration of the deduction.

Technical accessories: can they be included?

In some cases, the installation may include technical accessories such as covers for outdoor air conditioners or heat pumps, anti-vibration supports, or protective grilles. If these items are functional to the correct installation and are included on the same invoice, they may be included in the tax deduction.

We’ll explore all the details in the next article!