A quick recap of the 2025 Heat Pump Bonuses (Italy)

2025 brings to Italy several tax incentives designed to promote energy efficiency and home comfort. Among these, heat pumps play a central role thanks to their ability to reduce consumption and emissions compared to traditional systems. Let’s briefly look at the main heat pump bonuses available:

|

Renovation Bonus

|

|

Ecobonus

|

|

Thermal Account 3.0 (managed by GSE)

|

Sources:

Viessmann – Tax deduction guide, Bosch – 2025 heat pump incentives, Sky TG24 – 2025 air conditioner bonus

To learn more, see our dedicated guide to the 2025 air conditioner and heat pump bonus.

Heat pump accessories: when are they included in the Bonus?

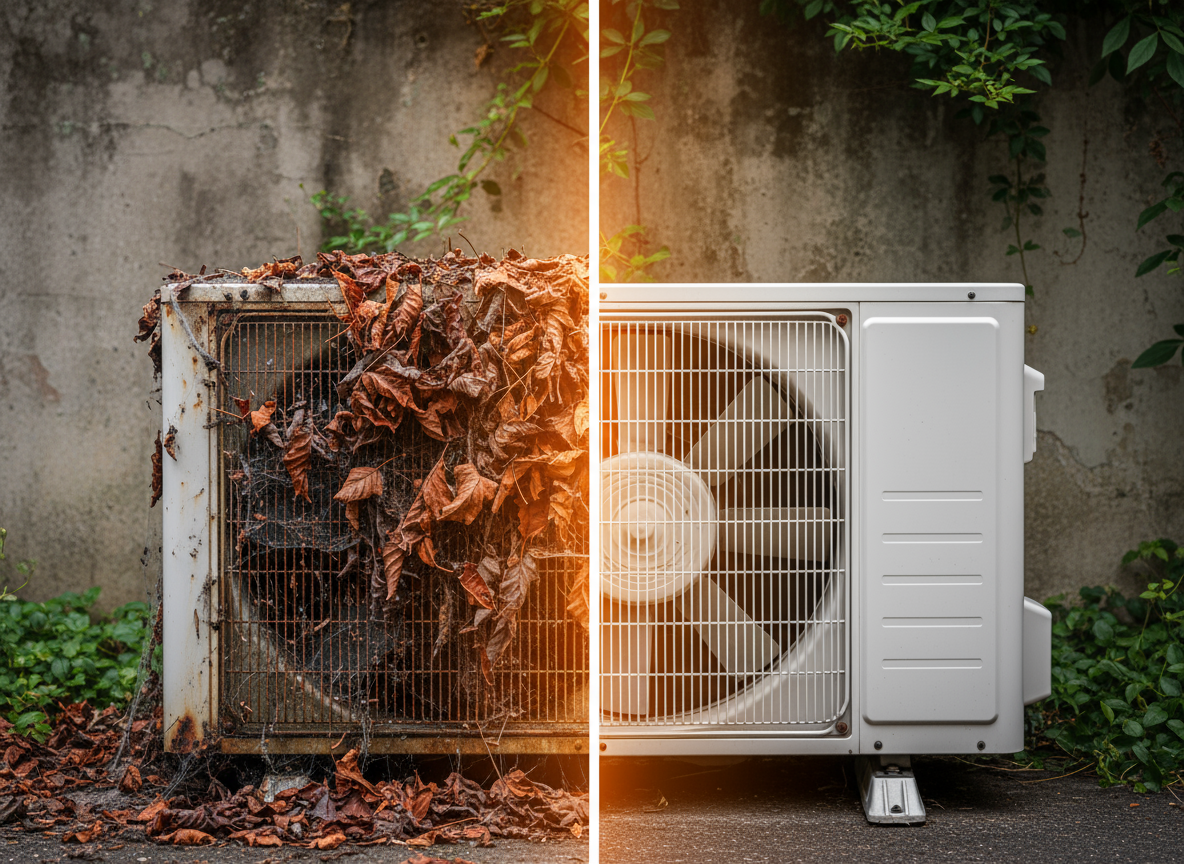

Installing a heat pump is a strategic investment to improve home comfort and reduce consumption. But to ensure this investment lasts over time, it’s often necessary to complete the system with technical accessories that protect its operation, improve performance, and reduce acoustic or visual impact.

These are functional, performance-enhancing, or protective components that, in many situations, can be included in the tax deduction provided by the 2025 heat pump bonus. Common examples include:

- Protective covers for outdoor heat pump units;

- Acoustic barriers and anti-vibration systems for residential contexts;

- Safety grilles, wall brackets, or reinforced plinths;

- Systems for aesthetic screening that integrate with the building’s architecture.

In these cases, we can speak of deductible accessories, but only under specific conditions that we’ll outline in detail shortly. First, however, it’s important to understand why adding accessories during installation can be a real advantage, both technically and fiscally.

A smart expense: when the cover becomes an integral part of the project

To access the 2025 heat pump bonus, the guiding principle is simple: the incentive applies to anything needed to put the system into operation efficiently, safely, and durably. This is where functional technical accessories—such as heat pump covers—come into play.

When properly included in the project design, a cover isn’t a decorative optional. It’s a component that actively contributes to protecting the system and can have direct effects on its efficiency over time.

Did you know manufacturers also require a cover in the manual?

It’s not an opinion.

It’s written in black and white in heat pump technical manuals: many manufacturers explicitly recommend protecting the outdoor unit to guarantee stated performance and extend its lifespan.

We invite every installer and owner to check their unit’s manual: in many cases, you’ll find a clear recommendation to adopt protective measures or covers to avoid malfunctions, premature degradation, and thermal dispersion. You’ll often find specific guidance to:

- avoid direct exposure to frost and driving rain;

- protect the unit from persistent humidity and extreme temperatures;

- shield the machine from salt air in coastal environments;

- screen against possible accidental impacts, falling objects, ice, and hail.

In all these cases, the cover becomes a recommended technical measure, not an embellishment: it’s a necessary element to ensure correct operation and maintain the declared energy efficiency. If installed at the same time as the system, and included on the invoice with a functional justification, it may meet all the requirements to be tax deductible.

We go into detail in this article → What does your outdoor unit’s installation manual ask you to do?

How to include heat pump covers in the tax paperwork: 4 rules to follow

Now that we’ve clarified the “why,” here’s how to ensure a heat pump cover actually qualifies for the 2025 Bonus. Precision is needed, but it’s absolutely feasible.

✓ Clear technical context

The installation must show that the cover is necessary for environmental, technical, or safety reasons and must be installed at the same time as the system. Even better if the manufacturer recommends it.

✓ Correct invoicing

The cover must be included on the invoice for the main intervention. No separate invoice and no DIY online purchase. Everything must be traceable, unified, justified, and purchased through the installer.

✓ Transparent description

The invoice line must specify that it’s a functional accessory, necessary for installation or protection of the system.

✓ Complete documentation

Technical sheet, system logbook, and the relevant manual page recommending its use: keep everything. Your accountant will need it too.

Box Air Klima: the cover designed to truly protect your heat pump

If you’re installing a heat pump, protecting the unit is not a detail to overlook. Environmental conditions—rain, frost, direct sun, impacts, salt air—can quickly compromise the system’s performance and lifespan.

Box Air Klima is a cover designed to address these real needs. Sturdy, functional, and easy to integrate, it helps to:

✓ shield the outdoor unit from harsh weather and mechanical stress;

✓ preserve the system’s energy performance over time;

✓ comply with recommendations from several manufacturers in installation manuals;

✓ offer a neat, elegant solution suitable even for demanding residential contexts.

If installed together with the system, invoiced by the installer on a single document, and justified as a functional accessory for protecting the unit, it can be included in the paperwork for the 2025 air conditioner and heat pump bonus.

FAQ about heat pump accessories and the 2025 Bonus

1. Are all heat pump accessories deductible?

No, only those that are functional to the proper operation and protection of the system.

2. Can I deduct a cover purchased online separately?

No, it must be installed and invoiced together with the system.

3. Are acoustic barriers considered deductible accessories?

Yes, if installed to comply with legal noise limits.

4. Can I claim the bonus for a heat pump installed in a second home?

Yes, but with a different rate (36% under the Renovation Bonus).

5. Are accessories also covered by the Thermal Account?

It depends: only if they are an integral part of the certified system.

6. Is it mandatory to attach technical documents for the accessories?

Not always, but it’s strongly recommended to avoid disputes.

Conclusion

Heat pump accessories are not just aesthetic details but an investment that safeguards your system’s performance and lifespan. If properly installed, described on the invoice, and justified as functional, they can fully qualify under the 2025 heat pump bonus.

Before proceeding, we always recommend:

- consulting with your installer;

- checking the manufacturer’s manual;

- keeping all documentation.

This way you’ll have an efficient, protected system that also benefits from tax incentives.